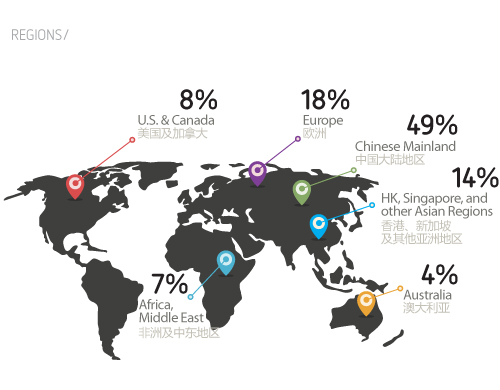

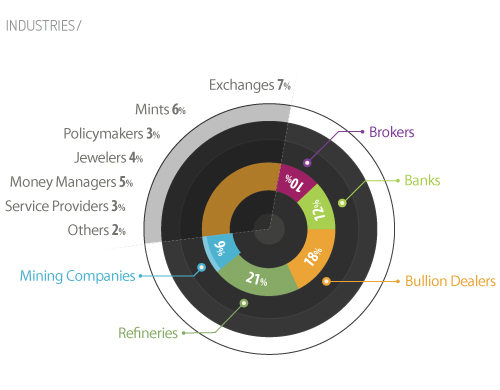

| China Gold & Precious Metals Summit, an annual precious metals gathering officially endorsed by the China Gold Association and the Shanghai Gold Exchange, has convened over 2100 senior executives from across the precious metals community including mining companies, refiners & fabricators, bullion dealers, mints, commodity & mercantile exchanges, investment & bullion banks, traders, brokerage firms, money managers, asset managers, central banks, sovereign wealth funds, jewelers, consultancies, service providers, trade associations as well as lawmakers in the past eight years.

Now in its 9th year, the conference will highlight precious metal prices and the supply & demand fundamentals for gold, silver, platinum and palladium, multiple headwinds weighing on gold as a combination of a firmer U.S. dollar, a strengthening U.S. recovery and a less accommodative Fed going forward, overall weak sentiment toward gold and silver as a result of better returns in equities and higher U.S. real rates, subdued physical gold demand out of China and India, China's push for a global trading platform for gold in Shanghai, the move by senior producers toward lower costs and capital discipline, and the ECB's stance on further monetary easing to combat falling inflation. |

|

|

|

|

|

|

Chairman / President / Executive Director / MD / CEO / GM

CIO / CFO / COO / VP / DGM

Regional Head / Country Head / Chief Representative

Head of FICC

Head of Precious Metals/ Metals/Commodities Trading

Head of Precious Metals/Metals/Commodities/Mining Research

Head of Trade Finance

Head of Precious Metals/Commodities

Head of Refining/Processing

Head of PM/Commodity Derivatives

Head of Metals Products

Head of Bullion & Treasury

Head of Numismatics

Dealing Director / Chief Dealer

Portfolio Manager, Commodities/Precious Metals

Head of Corporate Strategy

Head of Business Development

Head of Sales and Marketing |

| |

|

|

|

|

|

|

|