China Gold & Precious Metals Summit, an annual precious metal conference officially endorsed by the China Gold Association and the Shanghai Gold Exchange, has convened over 1500 senior executives from various stakeholders across the value chain including mining companies, investment & bullion banks, refiners & fabricators, bullion dealers, commodity & mercantile exchanges, brokerage firms, traders, capital management firms, sovereign wealth funds, jewelers, advisors, trade associations as well as regulators in the past six years.

The 2012 event will highlight the price trends and supply/demand outlook for gold, silver and platinum group metals, gold’s correlation with the U.S. dollar, the euro, riskier assets, safe-haven buying interest and macro stresses, the changing investor sentiment in response to debt issues, Fed stimulus, a gloomy outlook for the global economy and further central bank activity, the fabrication and investment demand for gold in China and India, China’s newly-launched silver futures contracts, the investment appeal of gold-mining shares and the challenges facing producers, and inflationary concerns in the wake of a fresh round of quantitative easing. |

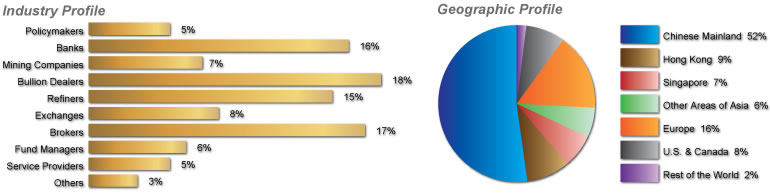

Previous Attendees Breakdown

| Who Will You Meet? |

|

Chairman / President / MD / CEO / GM

CIO / VP / DGM

Regional Head / Country Head / Chief Representative

Head of Precious Metals

Head of Precious Metals Trading

Head of Metals/Commodities Trading

Head of Metals/Commodities/Mining Research

Head of Precious Metals/Commodities Derivatives

Head of Bullion & Treasury

Head of Metals Products

Dealing Director / Chief Dealer

Portfolio Manager, Commodities

Head of Corporate Strategy

Head of Business Development

Head of Sales and Marketing |

|

|

|

|